Not known Facts About Life Insurance Quote Online

Table of ContentsThe Greatest Guide To Life Insurance Quote Online10 Simple Techniques For Life Insurance Louisville KyThe Main Principles Of Term Life Insurance 9 Simple Techniques For Whole Life InsuranceThe Ultimate Guide To Life Insurance Louisville Ky

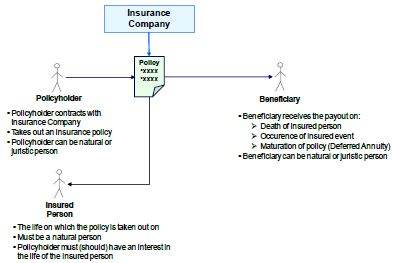

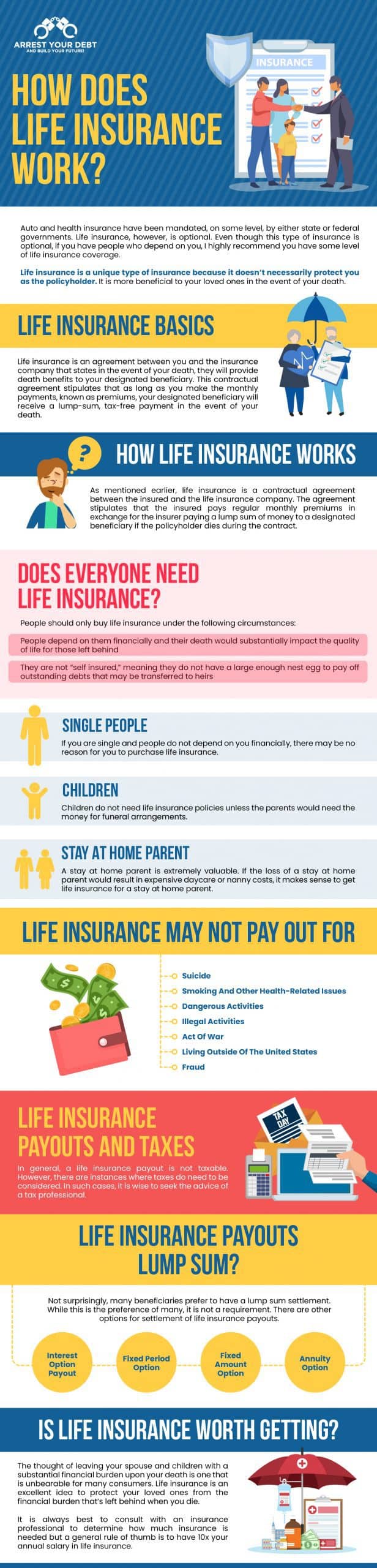

Life insurance policy offers monetary security for individuals you appreciate. You pay a monthly or yearly premium to an insurer, as well as in exchange the business pays a tax-free lump amount of money to your recipient if you die while the plan is active. You can personalize your life insurance policy policy to fit your family members's needs by choosing the kind of plan you buy, the variety of years you want it to last, as well as the quantity of cash paid out - Term life insurance Louisville.Life insurance coverage is a very typical possession that figures right into lots of people's lasting economic preparation - Whole life insurance Louisville. Getting a life insurance policy is a way to safeguard your liked ones, offering them with the monetary assistance they may require after you die. You may buy life insurance coverage to assist your partner cover home loan repayments or daily costs or money your kids's college education and learning.

Key Takeaways Life insurance is a contract between a policyholder as well as an insurance policy business that's developed to pay out a fatality benefit when the guaranteed individual passes away. A life insurance policy company need to be spoken to as quickly as possible adhering to the death of the insured to begin the insurance claims and payment procedure - Life insurance Louisville KY.

The 5-Minute Rule for Life Insurance Quote Online

There are different methods a recipient may get a life insurance coverage payout, consisting of lump-sum settlements, installation repayments, annuities, as well as kept property accounts. Life Insurance policy Basics Life insurance coverage is a type of insurance policy contract.

Some life insurance policy policies can provide both death benefits and also living benefits. A living benefit biker permits you to take advantage of your policy's survivor benefit while you're still active. This kind of motorcyclist can be useful in circumstances where you're terminally sick and also need funds to pay for treatment.

These plans allow the insurance policy holder to be the beneficiary of their very own life insurance plan," claims Ted Bernstein, proprietor of Life Cycle Financial Planners LLC. When acquiring life insurance coverage, it is necessary to take into consideration: Just how much insurance coverage you need Whether a term life or long-term life plan makes extra sense What you'll pay for costs Which motorcyclists, if any, you would certainly such as to include The distinctions in between life insurance prices estimate for each and every prospective policy In terms of protection quantities, a life insurance policy calculator can be helpful in picking a survivor benefit.

Whole Life Insurance Fundamentals Explained

Life insurance coverage premium costs can depend on the kind of policy, the quantity of the fatality advantage, the motorcyclists you include, as well as your general health.

Minor kids can not be named as recipients of a life insurance policy. Suing Survivor benefit are not paid out immediately from a life insurance policy policy. The recipient has to first submit a case with the life insurance policy business. Relying on the insurance provider's plans, this might be done online or it may require a paper declares declaring.

The 30-Second Trick For Life Insurance Companies Near Me

There's no collection due date for for how long you have to file a life insurance policy case yet the faster you do so, the far better. When Benefits Are Paid Life insurance policy benefits are typically paid when the insured event passes away. Recipients submit a death case with the insurer by submitting a licensed copy of the fatality certificate.

If a firm refutes your case, it typically supplies a reason that. The majority of insurance policy firms pay within 30 to 60 days of the date of the claim, according to Chris Huntley, owner of Huntley Riches & Insurance Policy Services. "There is no set period," he includes. "However insurance provider are motivated to pay asap after receiving authentic evidence of fatality, to prevent steep rate of interest costs for delaying repayment of insurance claims." Payment Delays There are several feasible situations that may result in a delay in repayment.

Getting The Cancer Life Insurance To Work

The factor: the one- to two-year contestability condition. "The majority of plans have this condition, which enables the service provider to examine the original application to ensure scams was not dedicated. As long as the insurance provider can not show the insured rested on the application, the benefit will usually be paid," says Huntley.

If you or somebody you know is dealing with clinical depression or psychological health and wellness try here issues, get help currently. You are not alone. If you or a loved one is pondering self-destruction, speak to the National Self-destruction Avoidance Lifeline at 1-800-273-8255 or via online conversation. It's available 24 hours a day, 7 days a week, and offers totally free as well as confidential assistance.